![]() NETRONIC is the developer of the add-on and works with sales partners like us who implement and support the add-on at companies.

NETRONIC is the developer of the add-on and works with sales partners like us who implement and support the add-on at companies.

Be honest with yourself: How efficient are your financial processes? Do you make too many careless mistakes in payments, banking or balance sheet preparation, or do you simply lose too much time due to cumbersome processes or missing functionalities in the standard Dynamics 365 Business Central?

We know the problem: Let us improve your processes together.

To optimize your processes, our partner Continia has developed a great solution: OPplus 365.

Your big advantage: With many years of experience in the industry, Continia knows exactly the complex processes and the increasing data streams that have to be processed in the finance departments of companies. OPplus 365 was developed to simplify the workspace around the coordination of accounts receivable, accounts payable, banks and tax offices and to improve asset accounting. We are pleased to say that this is the case.

The software consists of a base module and a collection of other modules, so you can customize the features your business needs. You can freely choose from the following modules:

1 The base modul:

The basis of OPplus 365 is the payment import as well as the payment export.

Payment import

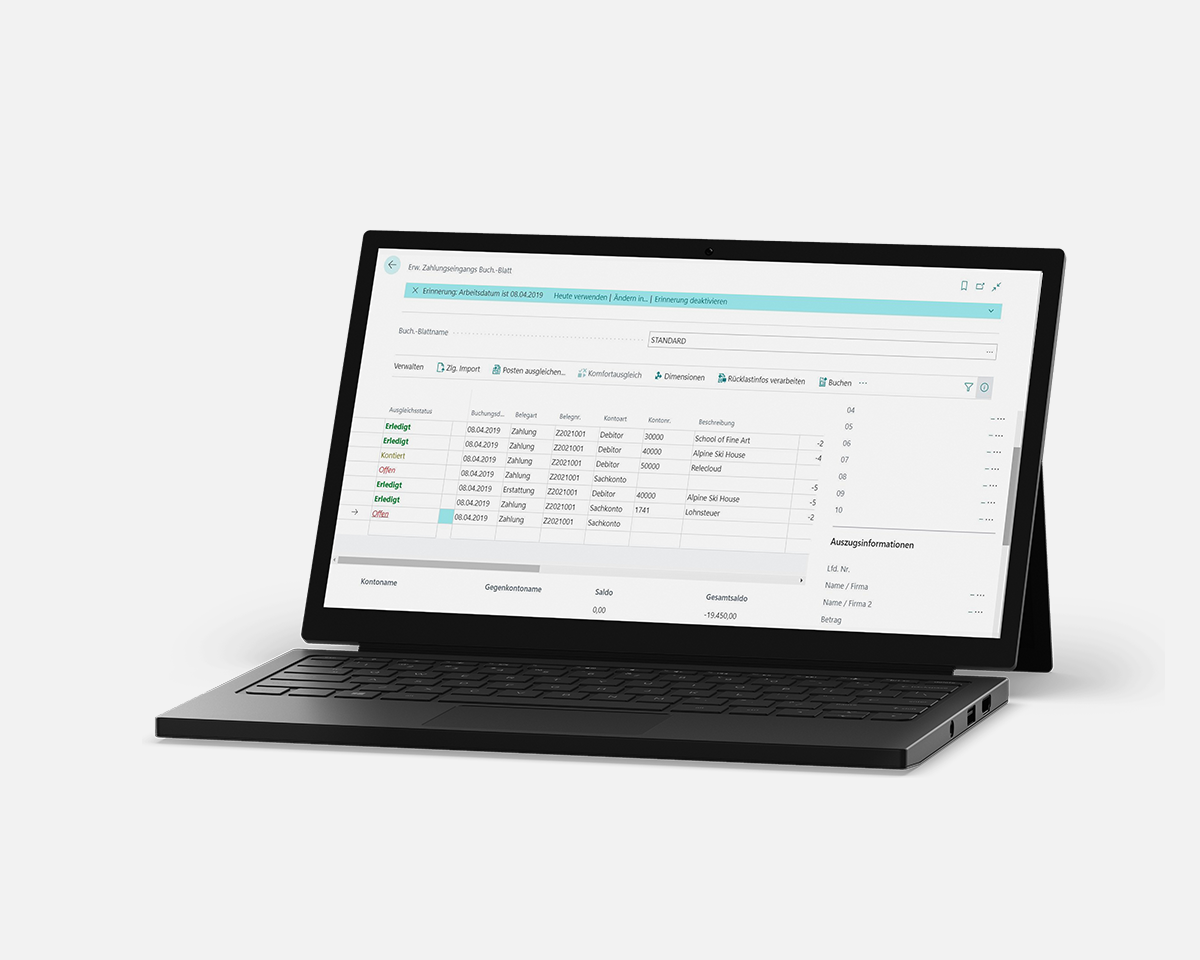

The payment import of OPplus 365 creates new possibilities for the organization of payment transactions and, in addition, transparency with regard to cleared items and assigned payments. There is also the option of automatic clearing and automatic pre-accounting. Furthermore, with the help of the app, customer advices can be imported and accounts can be balanced in less time. Lastly, optimized search routines speed up the manual allocation of remaining payments.

Payment export

OPplus 365’s payment export simplifies the handling of payment processes. It also creates more transparency between cleared items and allocated payments. You are able to create payment proposals and payment runs for non-cash payments in just one step. It doesn’t matter what file format or payment direction is involved, or whether it’s a transfer, direct debit or check.

2 The extensions modules:

With the module “Extended Asset Accounting” you have many features at hand:

Take advantage of the optimized display of entries

on screen and in print. Items can be annotated and printed if required – in the account sheet, on the open items list or separately. In addition, you have the option of subsequently changing your posting text or the external document number. Create balance confirmations with credit and debit notes for customers and vendors and send them by e-mail.

Also print meaningful reports such as:

The free module “Petty Cash and Check deposit” is divided into two areas:

Petty Cash

This function enables the user to maintain the petty cash directly in OPplus 365 and to print any required reports by using the system. In comparison to the journal of the standard application, the Petty cash allows the user to get a quick overview of the current balance of the cash account as well as of the balance after posting. In addition, a plausibility check is offered by this module to ensure that no negative cash values exist.

Check Deposit

The Cash Receipt Journal functionality is intended for use by companies which submit any check payments at the bank received for the settlement of sales invoices.

Banks normally expect that the check receipts are filled in – a process which in practice is done manually. The checks (or the check credits) are later on manually assigned to the sales invoices in Microsoft Dynamics 365 Business Central. By using the Check Receipt Journal feature, you can avoid double entries without being limited to a specific number of checks for each check receipt Journal.

As with customer and vendor accounts, you can create open entries for G/L accounts. This facilitates very much the handling of for instance cash in transit, accruals and deferrals or any other items in transit. Your benefits:

Our module multi-level cash discount gives you the possibility to consign up to 4 additional discount formulas and discount percentages. These additional cash discount deduction rules are taken account of in the payment import and payment export modules.

If you want to arrange Payment installments with your suppliers or customers you can use the option of generating installment payment documents with different due dates. Your benefits:

Especially if you manage many clients, this module offers a lot of comfort:

In combination with the Payment Import and Export modules Associations can be a very useful additional feature of OPplus. Associations manages your open entries in associations of accounts receivables and accounts payables.

Your benefits:

You have the possibility to have payments settled through central regulators. You can combine several customers to an association and have all open entries for these associated customers settled by a single customer who pays all invoices related to the association.

With Associations you can furthermore group customers and vendors. A group always consist of one customer and one vendor for who open items can be settled automatically in the course of Payment Processing.

Automate your bank communication or your bank connection to Dynamics 365 Business Central easily with windata’s add-on konfipay.

Via an interface, konfipay and the complete solution OPplus 365 can effectively cooperate with your ERP solution Dynamics 365 Business Central. With one click, you can retrieve data from your bank or transfer it to OPplus 365 via the konfipay web service. With konfipay, you can completely replace your possibly outdated banking software.

It’s me again, Theo the technology interpreter! If you don’t just want to know how the add-on will improve your everyday work, but want to dive deep into its functionality, you’ve come to the right place.

I would like to clarify how OPplus 365 extends the standard of Microsoft Dynamics 365 Business Central.

| Criteria | System standard | OPplus 365 |

|---|---|---|

| Bank account reconciliation | ✔ | ✔ |

| Cross-client import of bank statements | – | ✔ |

| Import CAMT | ✔ | ✔ |

| Import MT940 | – | ✔ |

| Extensive set-up options for account assignments and clearing determinations | – | ✔ |

| Import CSV (for payment advice reading, also files from payment providers with OP clearing) | – | ✔ |

| Account assignment rules (with splitting of an amount to an infinite number of split postings with specifications of all eight shortcut dimensions) | – | ✔ |

| Business transaction code rules (with splitting of an amount to an infinite number of split entries with specifications of all eight shortcut dimensions) | – | ✔ |

| Automated multiple clearing (for collective payments) | – | ✔ |

| Criteria | System standard | OPplus 365 |

|---|---|---|

| SEPA payments | ✔ | ✔ |

| Same handling for debit-side and credit-side payment proposals | – | ✔ |

| Automatic cash discount deduction options for customer debit memos | – | ✔ |

| Cross-format payment proposals (e.g. disbursements to customers) | – | ✔ |

| Payment proposal with options for general cash discount | – | ✔ |

| Filtering options at item level for payment proposals | – | ✔ |

| Flexible adjustment of payment notes | – | ✔ |

| Release function for the creation of payment data | – | ✔ |

Functions

Deployment*

Compatibility*

*Please contact us with detailed questions about supported versions.

High security

Safety first! Benefit from a high level of in-house security thanks to the integrated release function.

Savings in time

You can save time by using automatic proposals as well as automating the account assignment of recurring entries.

Act flexible

The modular design allows functions to be added flexibly. Customized according to your needs.

Our partner company Continia Software is dedicated to accelerating your processes. In more than 25 years Continia has gained experience in making Microsoft Dynamics 365 Business Central (formerly Dynamics NAV/Navision) more effective.

From automated document processing to the financial management solution OPplus and automated registration of travel activities, Continia Software offers many useful add-ons.

Price overview

Navigate to the price overview of all products. There you will find the prices for OPplus 365.