![]() Visiondata is the manufacturer of the add-on and works with sales partners like us who implement and support the add-on at companies.

Visiondata is the manufacturer of the add-on and works with sales partners like us who implement and support the add-on at companies.

In Dynamics 365 Business Central Standard, you have basic functions for checking the VAT ID number: You can only check the VAT ID number against the VAT Information Exchange System (VIES) in customer, vendor and contact master data and log this check.

We have a convenient solution from our partner company Visiondata up our sleeve that offers much more.

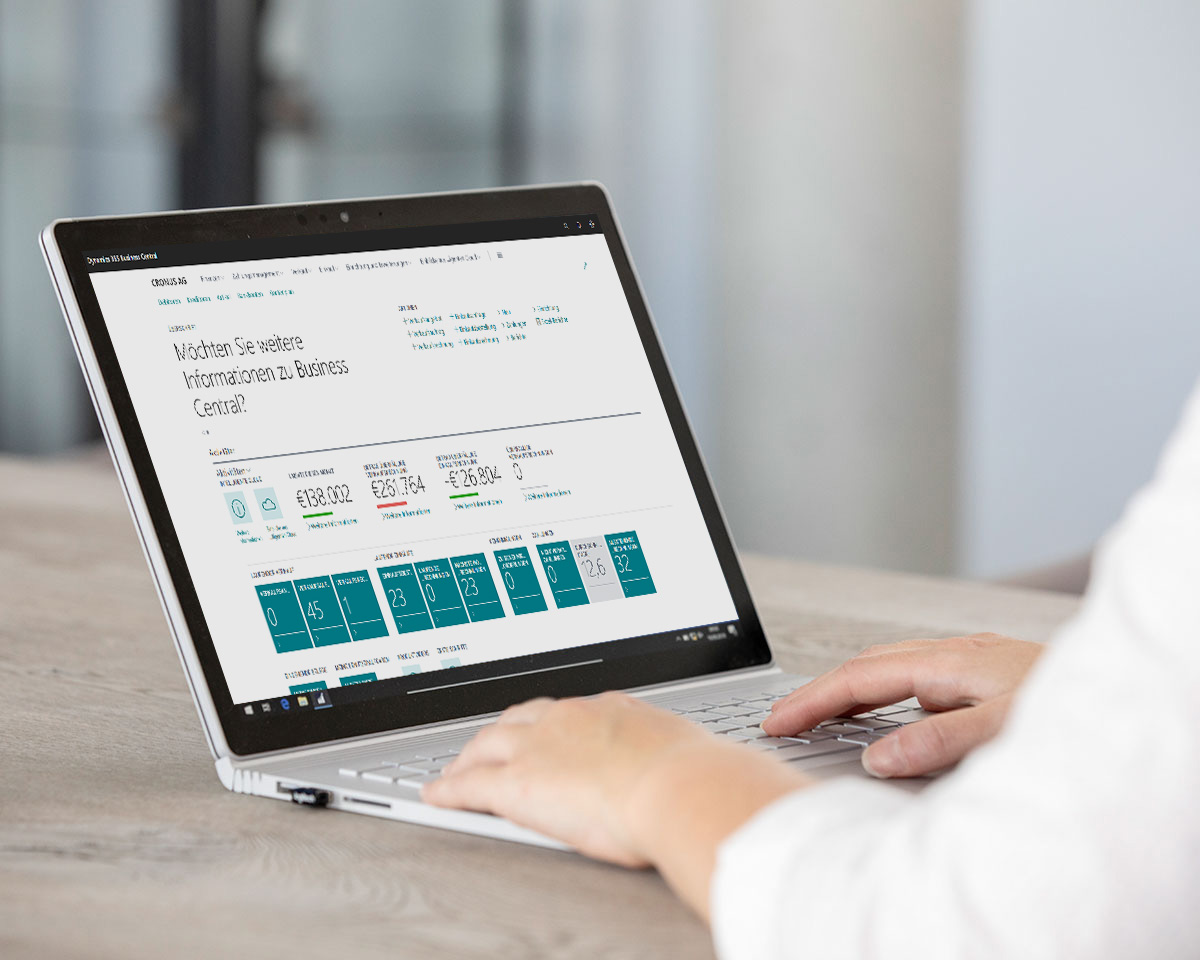

Visiondata’s VAT ID check add-on is a simple and flexible tool for checking directly in Microsoft Dynamics 365 Business Central/NAV in real time and without system breaks.

It allows you to easily comply with the requirements of a VAT-exempt EU delivery according to § 6a para. 4 UStG. Thus, at the time of a delivery, it is mandatory that you check the VAT identification number, the name of the business partner, the legal form as well as the address of the customer for validity according to § 18e UStG. If you fail to do so, you will be liable for tax to the tax office as the supplying company.

Mit dem Laden des Videos akzeptieren Sie die Datenschutzerklärung von YouTube.

Mehr erfahren

It’s me again, Theo the technology interpreter!

I would like to clarify how the VAT ID check add-on extends the standard of Microsoft Dynamics 365 Business Central. You will love it!

| Criteria | System standard | Visiondata VAT ID number check |

|---|---|---|

| Audit in the Federal Central Tax Office database | – | ✓ |

| Audit in the VAT Information Exchange System (VIES) database | ✓ | ✓ |

| Qualified audit (Checking the VAT number, name of the business partner, legal form and the address of the customer for validity) | – | ✓ |

| Multiple VAT ID numbers | – | ✓ |

| Audit in debtor, creditor and contact master data | ✓ | ✓ |

| Audit in purchase and sales documents (entry, approval, delivery, invoicing) | – | ✓ |

| Audit in purchase and sales ledger sheets (entry, posting) | – | ✓ |

| Logging of the audit | ✓ | ✓ |

| Logging according to UStAE18e.1 | – | ✓ |

| Batch testing (check multiple numbers at once) | – | ✓ |

Functions

Deployment*

Compatibility*

*Feel free to contact us with detailed questions about supported versions.

Real-time response

You can map the VAT ID check directly in Business Central. This means that you do not need to change systems.

Legally compliant

Meet legal requirements with Visiondata’s tool integrated with Dynamics 365 Business Central.

Productive work

Inspire your employees with an add-on from Visiondata, making you more productive and faster.

Visiondata offers business add-ons for Microsoft Dynamics 365 Business Central. The focus is on certified industry solutions in the area of accounting. The company is headquartered in Hamburg and currently employs around 40 people.

The cost of the add-on cannot be given as a lump sum. It depends on the exact functionality you need and how many users you want to license it for. Feel free to contact us for a consultation. We look forward to helping you!